Economic Action Plan 2015

BECOME A MEMBER

Keep up with current happenings inBattlefords-Lloydminster.

The Budget in Brief 2015

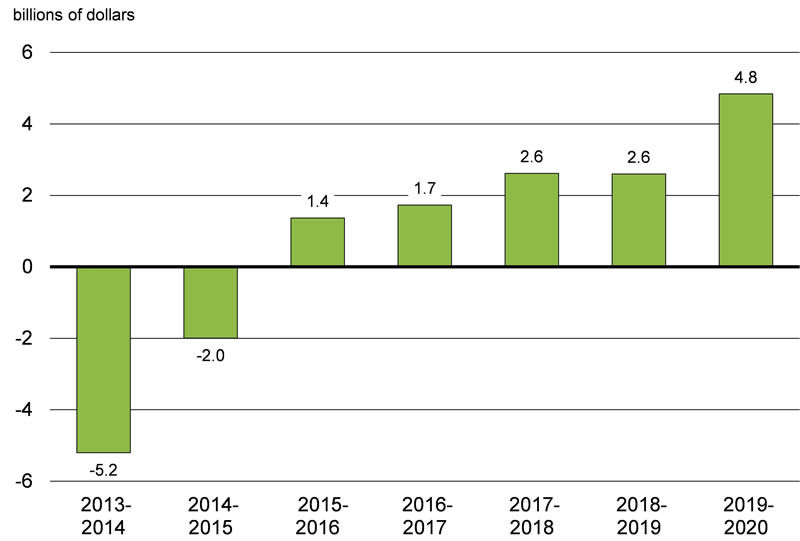

The Government is fulfilling its promise to balance the budget in 2015, pursuant to its long-standing commitment to responsible fiscal management. Economic Action Plan 2015 will see the budget balanced and Canadians can rest assured that Canada’s fiscal house is in order.

Under the Government’s Economic Action Plan, the deficit has been reduced from $55.6 billion at the height of the global economic and financial crisis to a projected surplus of $1.4 billion for 2015–16 (Chart 1.1).

Sources: Public Accounts of Canada; Department of Finance.

Canada’s Economic Action Plan has been underpinned by prudent fiscal management and the Government’s low-tax plan for families and businesses. Since 2006, the Government’s priorities have been to create well-paying and secure jobs for Canadians, lower taxes for Canadian families and businesses, and balance the budget.

This Government has lowered taxes every year since coming into office. In fact, since 2006 the Government has introduced over 180 tax relief measures. The overall federal tax burden is now at its lowest level in more than 50 years.

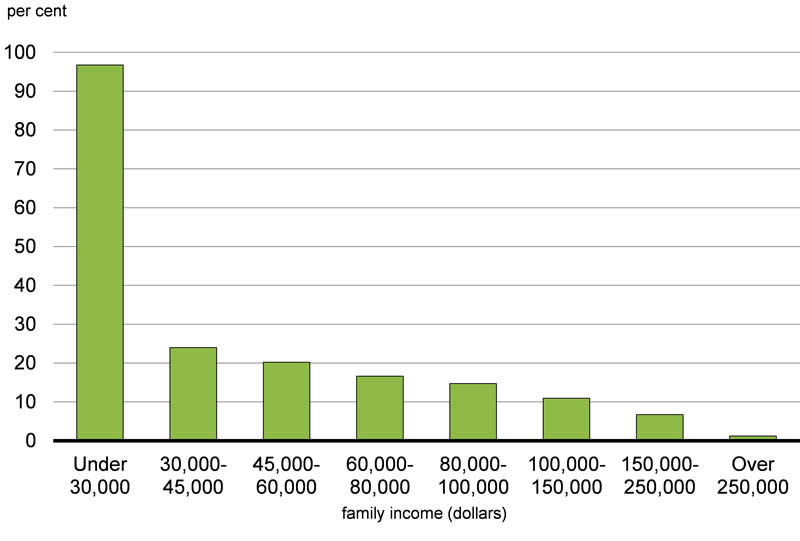

Canadian families and individuals have benefitted from significant tax reductions that have given them the flexibility to make the choices that are right for them. Canadians at all income levels are benefitting from the tax relief introduced by the Government, with low- and middle-income Canadians receiving proportionally greater relief (Chart 1.2).

Notes: Tax paid equals federal personal income tax payable for 2015 in the absence of tax relief provided since 2006. Tax relief provided since 2006 excludes increases in benefits.

Source: Department of Finance.

Tax relief measures introduced since 2006, in combination with benefit increases, are leaving more money in the pockets of all Canadians:

- Canadian families and individuals will receive $37 billion in tax relief and increased benefits in 2015–16 as a result of actions taken since 2006.

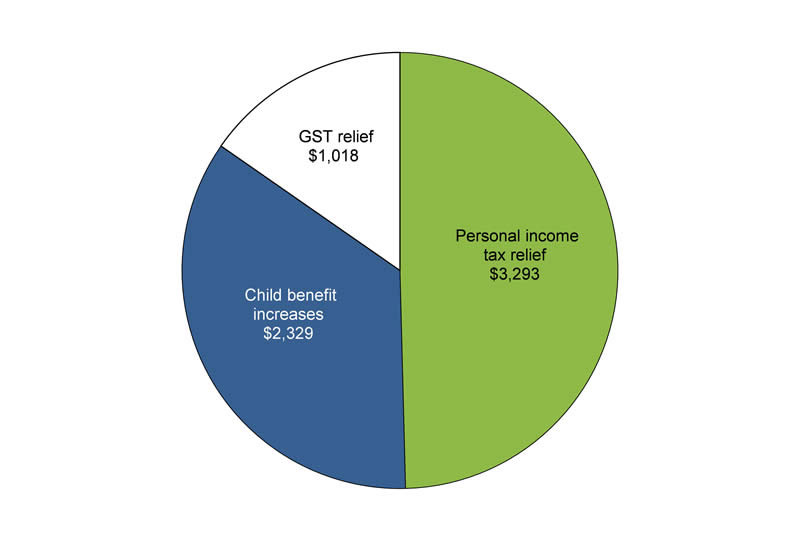

A typical two-earner family of four will receive tax relief and increased benefits of up to $6,600 in 2015, as a result of the Family Tax Cut, the Universal Child Care Benefit, the Goods and Services Tax (GST) rate reduction, the introduction of new credits, such as the Children’s Fitness Tax Credit, and broad-based income tax relief including the reduction in the lowest personal income tax rate (Chart 1.3).

Henry and Cathy are a couple with two children, Grace and Elizabeth. Henry earns $84,000 and Cathy earns $36,000. As a result of actions taken by the Government since 2006, their family will receive $6,640 in tax relief and enhanced benefits in 2015, allowing Henry and Cathy to invest their hard-earned money where they see fit.

As shown below, this tax relief and these enhanced benefits include:

- $3,293 in income tax relief, of which $1,865 is due to measures announced in the 2014 Family Package;

- $2,329 in enhanced benefits, including $1,224 as a result of the enhanced Universal Child Care Benefit announced in the 2014 Family Package; and

- $1,018 from the Government’s reduction of the GST rate from 7 per cent to 5 per cent.

Total Federal Tax Relief and Increased Benefits = $6,640

Source: Department of Finance.

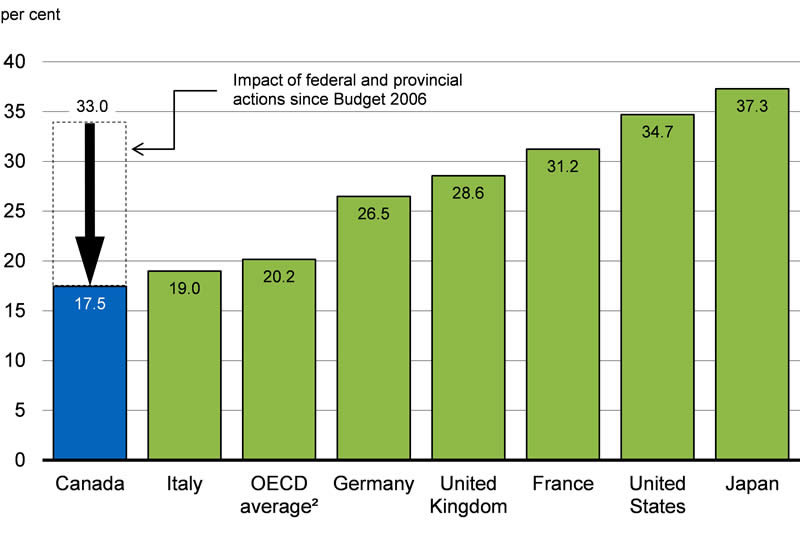

The Government’s low-tax plan is also giving businesses strong incentives to invest in Canada. This helps the economy grow, spurs job creation and raises Canada’s standard of living. Actions taken by the Government since 2006, including those proposed in Economic Action Plan 2015, will reduce taxes for job-creating businesses by $14.7 billion in 2015–16. Canada now has the lowest overall tax rate on new business investment in the Group of Seven (G-7) (Chart 1.4).

1 The marginal effective tax rate (METR) on new business investment takes into account federal, provincial and territorial statutory corporate income tax rates, deductions and credits available in the corporate tax system and other taxes paid by corporations, including capital taxes and retail sales taxes on business inputs. The methodology for calculating METRs is described in the 2005 edition of Tax Expenditures and Evaluations (Department of Finance). The METR includes measures announced as of January 1, 2015 that will be in effect on December 31, 2015. It excludes the resource and financial sectors and tax provisions related to research and development.

2 OECD (Organisation for Economic Co-operation and Development) average excludes Canada.

Source: Department of Finance.

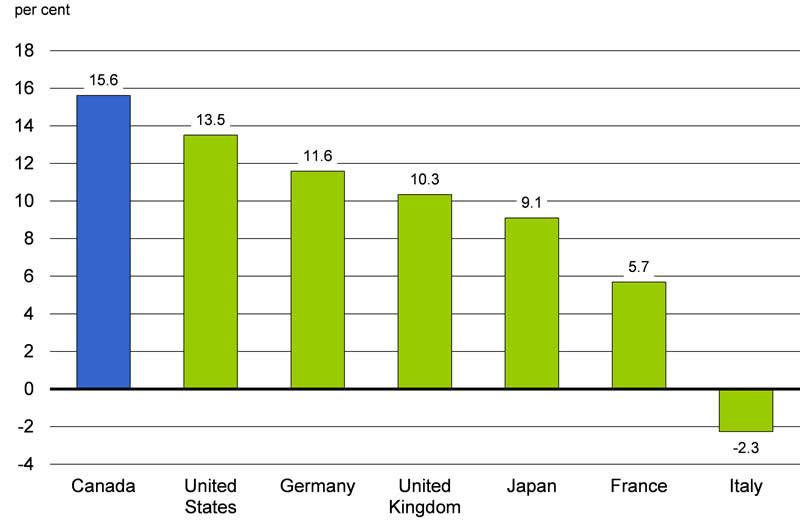

Canada’s Economic Action Plan is working. Canada continues to move forward in the face of a fragile external environment and profound global economic uncertainty. Canada has achieved one of the best economic performances among G-7 countries over the recovery. Indeed, real gross domestic product (GDP) has increased more in Canada than in any other G-7 country since the end of the recession (Chart 1.5).

Notes: The trough was 2009Q1 for Germany and Japan and 2009Q2 for Canada, the United States, the United Kingdom, France and Italy. The last data point is 2014Q4 for all countries.

Sources: Haver Analytics; Department of Finance calculations.

Reflecting this solid performance, over 1.2 million more Canadians are working now than at the end of the recession in June 2009—one of the strongest job creation records in the G-7 over this period. The majority of these net new jobs have been full-time positions in high-wage, private-sector industries.

The Government’s prudent fiscal plan has carefully steered Canada to balanced budgets in the face of headwinds, such as the sharp decline in crude oil prices—the third-largest decline in the last three decades. All the while, the Government has remained committed to putting money back in the pockets of hard-working Canadian families and businesses.

Our Government is fulfilling its promise to balance the federal budget. We are now in a position to fulfill our promise to help Canadian families balance theirs.

Actions taken by the Government over the past year will help further support economic growth and the creation of jobs in Canada. On a cash basis, these include:

- Support for Canadian families through the new Family Tax Cut and Universal Child Care Benefit enhancements totalling $7.8 billion in 2015–16 and over $4.5 billion ongoing.

- Support for small businesses through the Small Business Job Credit and Employment Insurance (EI) premium freezes for three years, followed by a committed reduction in EI premiums to a seven-year break-even rate in 2017.

- $5.8 billion in new investments that will continue to build and renew federal infrastructure across the country, with the majority of this support being delivered within three years.

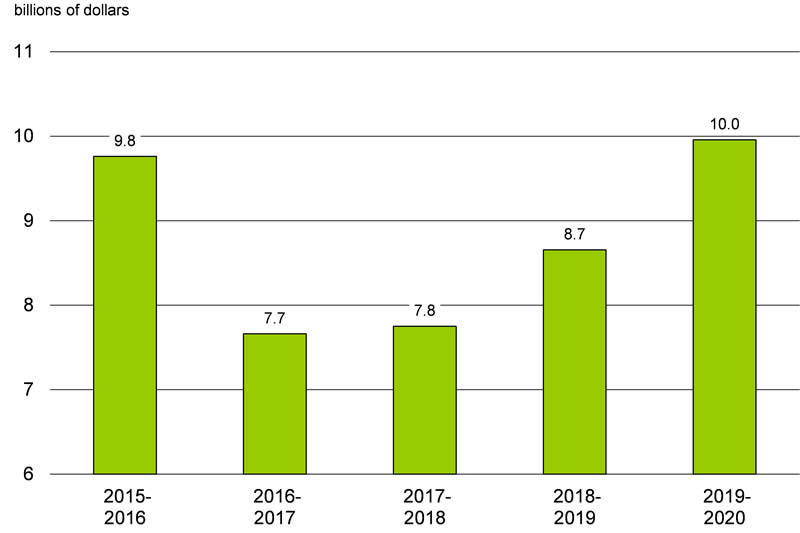

These measures, together with those announced in Economic Action Plan 2015, total almost $10 billion in 2015–16, or 0.5 per cent of GDP, and average $8.5 billion per year thereafter, on a cash basis (Chart 1.6). This will provide significant support to the Canadian economy starting in the second quarter of 2015.

Note: The value of these measures is presented here on a cash basis, rather than an accrual basis, as the cash outlays correspond to economic activity in the years shown.

Source: Department of Finance.

Sound and sustainable public finances are paramount to ensuring ongoing economic growth and job creation over the longer term. Balanced budgets ensure low taxes, support the sustainability of the services and programs Canadians depend on, and inspire confidence in investors and consumers.

In this challenging environment, it is vital that the federal government stay focused on balancing its budget…

Prior to the global recession, the Government reduced Canada’s debt by more than $37 billion and the federal debt-to-GDP ratio to 28.2 per cent. As a result, Canada was well positioned to weather the storm as the global economy fell into recession. Canada was able to emerge from the recession faster and stronger than virtually any other major advanced economy.

In successive budgets, beginning with Budget 2010, and as the economy recovered, the Government wound down fiscal stimulus and controlled spending to engineer a return to balanced budgets.

Having balanced the budget, the set-aside for contingencies will continue to protect the fiscal outlook from global economic uncertainty, and will be used to reduce the level of federal debt, if it is not required.

At the G-20 Leaders’ Summit in 2013, Prime Minister Stephen Harper announced Canada’s commitment to achieve a federal debt-to-GDP ratio of 25 per cent by 2021. In the 2013 Speech from the Throne, the Government committed to reduce the debt-to-GDP ratio to pre-recession levels by 2017. The Government remains on target to meet both commitments.

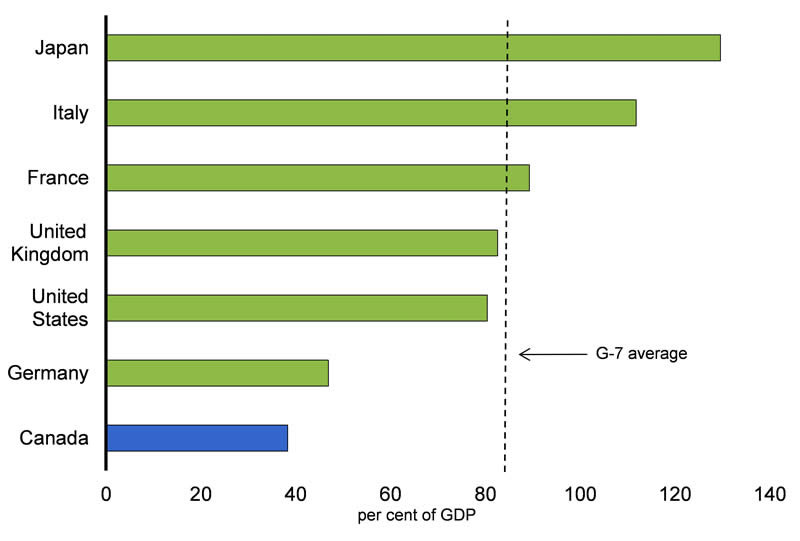

The Government’s commitment to balanced budgets has made Canada a recognized leader for fiscal stewardship on the world economic stage. Canada’s total government net debt-to-GDP ratio remains the lowest of any G-7 country and among the lowest of the advanced G-20 countries (Chart 1.7).

Note: The total government net debt-to-GDP ratio is the ratio of total liabilities net of financial assets of the central, state and local levels of government, as well as those in social security funds, to GDP. For Canada, total government includes the federal, provincial/territorial and local government sectors, as well as the Canada Pension Plan and the Québec Pension Plan. For international comparability, adjustments are made to unfunded public pension liabilities.

Source: International Monetary Fund, Fiscal Monitor, April 2015.

Reducing Canada’s debt burden is also a question of intergenerational fairness—it would simply not be fair to saddle our children and grandchildren with inevitable tax hikes to pay for the expenses we could not settle ourselves.

Balancing the budget takes hard work and tough choices. A balanced budget:

- Ensures taxpayer dollars are used to support important social services—such as health care—rather than paying interest costs.

- Preserves Canada’s low-tax plan and allows for further tax reductions, fostering growth and the creation of jobs for the benefit of all Canadians.

- Helps to instill confidence in consumers and investors, whose dollars spur economic growth and job creation.

- Strengthens the country’s ability to respond to longer-term challenges, such as population aging, and unexpected global economic shocks.

- Signals that public services are sustainable, ensuring fairness for future generations by avoiding future tax increases or reductions in services.

To secure recent gains, the Government is proposing to enshrine in law its prudent approach to fiscal planning by introducing balanced budget legislation. This proposed legislation confirms the Government’s ongoing commitment to responsibly managing taxpayers’ money.

Economic Action Plan 2015

Going forward, global economic uncertainty dictates that for Canada to become an even safer, more confident and more prosperous country, the Government must continue to take responsible and deliberate steps to create jobs, foster economic growth and maintain its commitment to fiscal responsibility.

Canada’s Economic Action Plan is working, but the job is not done and there are new challenges on the horizon. The Government must stay the course to protect the economic interests of Canadians and the security of Canada.

Economic Action Plan 2015 will continue to implement measures that support what matters to Canadians:

- Supporting jobs and growth by maintaining the right economic environment to allow job-creating businesses to thrive and reach new markets with their products, proposing new investments in public infrastructure, and training a highly skilled workforce that is responsive to the evolving needs of employers.

- Helping families and communities prosper by continuing to provide tax relief for Canadian families and individuals, enhancing opportunities for all Canadians, and celebrating Canada’s cultural and natural heritage.

- Ensuring the security of Canadians by continuing to support the Canadian Armed Forces and protecting Canadians from the threat of terrorism at home and abroad.

Maintaining focus on these priorities is the best way to ensure that Canada’s future is secure and prosperous, with a healthy economy fuelled by low taxes and sustainable public finances.

Economic Developments and Prospects (Chapter 2)

- The Canadian economy has experienced one of the best performances among the Group of Seven (G-7) countries over the recovery.

- Over 1.2 million more Canadians are working now than at the end of the recession, one of the strongest job performances among G-7 countries over this period.

- Since mid-2014, weak global growth, combined with continued steady increases in oil supply, has led to significant declines in world crude oil prices.

- This is affecting Canada, which is a producer and net exporter of crude oil.

- However, the Canadian economy is resilient: real gross domestic product (GDP) is expected to grow at a pace of about 2 per cent in both 2015 and 2016.

- Moreover, actions taken by the Government in the fall of 2014 and in Economic Action Plan 2015 will provide almost $10 billion of support to the Canadian economy this fiscal year, starting in the second quarter of 2015.

- Risks to the Canadian economic outlook remain largely external, stemming from the uncertainty surrounding both the future path of oil prices and global growth.

Supporting the Manufacturing Sector and Investing in Advanced Research (Chapter 3.1)

Since 2006, the Government has taken action to reduce taxes to promote investment in Canada, and leverage the collective efforts of post-secondary institutions, industry, and government to build a robust research sector. Economic Action Plan 2015 builds on this foundation by:

Encouraging Investment in Canada’s Manufacturing Sector

- Maintaining a low tax burden on businesses to encourage investment in Canada.

- Providing manufacturers a 10-year tax incentive to boost productivity-enhancing investment.

- Providing up to $100 million over five years, starting in 2015–16, to support product development and technology demonstration by Canadian automotive parts suppliers through the new Automotive Supplier Innovation Program.

- Developing a national aerospace supplier development initiative.

- Providing $2.5 million per year, starting in 2016–17, to increase the analytical capacity needed to support the Defence Procurement Strategy.

Supporting World-Class Advanced Research

- Providing an additional $1.33 billion over six years, starting in 2017–18, to the Canada Foundation for Innovation to support advanced research infrastructure at universities, colleges and research hospitals.

- Creating a more efficient and effective national digital research infrastructure system by providing $105 million over five years, starting in 2015–16, to CANARIE, Canada’s world-class high-speed research and education network.

- Dedicating an additional $46 million per year to the granting councils, starting in 2016–17, focused in areas that will fuel economic growth and respond to important challenges and opportunities.

- Providing up to $243.5 million to secure Canada’s participation in the Thirty Meter Telescope and related domestic work on leading-edge components.

- Providing up to $72.3 million in 2015–16, on a cash basis, to Atomic Energy of Canada Limited to maintain safe and reliable operations at the Chalk River Laboratories.

- Providing an additional $30 million over four years, starting in 2016–17, to support cutting-edge research and technology development in Canada’s satellite communications sector.

- Extending Canada’s participation in the International Space Station mission to 2024.

- Dedicating $119.2 million over two years, starting in 2015–16, to the National Research Council’s industry-partnered research and development activities, helping Canadian businesses increase their competitiveness and develop new, cutting-edge products.

- Helping to develop the next generation of research and development leaders by providing $56.4 million over four years, starting in 2016–17, to Mitacs in support of graduate-level industrial research and development internships.

Helping Small Businesses and Entrepreneurs Create Jobs (Chapter 3.2)

This Government recognizes the vital role that small businesses play in creating jobs and generating economic growth. Since 2006, the Government has taken significant action to support job-creating businesses by lowering taxes, cutting red tape, and encouraging entrepreneurship. Economic Action Plan 2015 builds on this foundation by:

Helping Small Businesses Grow and Fostering Entrepreneurship

- Reducing taxes further for small businesses.

- Increasing the Lifetime Capital Gains Exemption to $1 million for owners of farm and fishing businesses.

- Improving access to financing for Canadian small businesses.

- Expanding services of the Business Development Bank of Canada and Export Development Canada to help small and medium-sized enterprises.

-

Increasing access to venture capital financing to help innovative,

high-growth companies grow and create jobs. - Providing $14 million over two years to Futurpreneur Canada in support of young entrepreneurs.

- Supporting the Action Plan for Women Entrepreneurs to help women business owners succeed.

Reducing Red Tape for Businesses and Enhancing Corporate Governance

- Reducing the frequency of remittances for the smallest new employers.

- Launching the planning and preparation required for federal adoption of the Business Number as a Common Business Identifier.

- Modernizing Canada’s federal corporate governance framework to facilitate best practices, including increasing women’s participation in corporate leadership.

Training a Highly Skilled Workforce (Chapter 3.3)

Since 2006, the Government has acted to ensure the development of a skilled, mobile and productive workforce. Despite significant investment, some challenges remain. Many Canadians are still out of work or underutilized at a time when there are skills and labour market shortages in certain sectors and regions. To this end, Economic Action Plan 2015 proposes additional concrete actions that respond to current labour market challenges and meet longer-term labour market needs, including:

Training the Workforce of Tomorrow

- Supporting provinces and territories to facilitate the harmonization of apprenticeship training and certification requirements in targeted Red Seal trades.

- Providing $1 million over five years to promote the adoption of the Blue Seal Certification program across Canada.

- Making a one-time investment of $65 million to business and industry associations to allow them to work with willing post-secondary institutions to better align curricula with the needs of employers.

- Expanding eligibility for the Low- and Middle-Income Canada Student Grants to short duration programs.

- Making the Canada Student Loans Program work for families by reducing the expected parental contribution under the needs assessment process.

- Removing the penalty on post-secondary students who work by eliminating in-study student income from the Canada Student Loans Program needs assessment process.

- Investing $248.5 million over five years in Aboriginal labour market programming.

- Investing $2 million over two years, starting in 2016–17, to expand the Computers for Schools program, extending access to refurbished computer equipment to non-profit organizations such as those that support low-income Canadians, seniors and new Canadians.

Supporting Canadian Workers

- Investing $53.8 million over two years to extend the current Employment Insurance Working While on Claim pilot project to August 2016.

- Enhancing labour market information, including the launch of a new one-stop national labour market information portal.

- Pursuing negotiations with provinces and territories on the $1.95-billion-per-year Labour Market Development Agreements to reorient training towards labour market demand.

- Providing $35 million over five years to make permanent the Foreign Credential Recognition Loans pilot project.

Ensuring a Safe and Healthy Workplace

- Strengthening Canada Labour Code protections for all employees and interns under federal jurisdiction.

- Providing $4.8 million over five years to increase compliance with the health and safety provisions of the Canada Labour Code.

- Modernizing the Government Employees Compensation Act to simplify and accelerate claims processing and clarify coverage.

- The Government will make every effort to reach agreement with bargaining agents within a reasonable timeframe on necessary reforms to disability and sick leave management.

Investing in Infrastructure (Chapter 3.4)

Our quality of life and ability to compete on the global stage depend on the performance and quality of our public infrastructure. In Economic Action Plan 2015, this Government continues to make unprecedented long-term investments to ensure that Canadians continue to benefit from world-class infrastructure across the country by:

Investing in Infrastructure

- Continuing to provide $5.35 billion per year on average for provincial, territorial and municipal infrastructure under the New Building Canada Plan.

- Increasing the borrowing limits of the Government of the Northwest Territories to $1.3 billion and the Government of Nunavut to $650 million, upon approval of the Governor in Council.

- Providing an additional $750 million over two years, starting in 2017–18, and $1 billion per year ongoing thereafter for a new and innovative Public Transit Fund—the Government’s largest targeted infrastructure program—to promote public transit infrastructure investment in a manner that is affordable for taxpayers and efficient for commuters.

- Creating a new dedicated infrastructure fund to support the renovation, expansion and improvement of existing community infrastructure in all regions of the country as part of the Canada 150 celebrations.

- Continuing to build and renew federal infrastructure and on-reserve schools, including through $5.8 billion in investments over six years.

- Reviewing the usefulness of the rule that restricts federal pension funds from holding more than 30 per cent of the voting shares of a company.

Growing Trade and Expanding Markets (Chapter 3.5)

International trade and investment are vital to the continued growth of the Canadian economy and contribute to the prosperity of people and businesses across Canada, including in the natural resources sector. Since 2006, the Government has worked tirelessly to ensure that Canadian exporters and investors have access to foreign markets and preferential terms of trade and investment with other nations, and that Canada responsibly develops its natural resources for the benefit of all Canadians. Economic Action Plan builds on this track record by:

Fostering Trade

- Providing $50 million over five years for a program to share the cost of exploring new export opportunities with small and medium-sized enterprises.

- Providing $42 million over five years to expand the footprint and resources of the Trade Commissioner Service.

- Securing agriculture market access by providing $18.1 million over two years, starting in 2016–17, to promote competitiveness and trade opportunities for the agriculture and agri-food sector.

- Providing an additional $12 million over two years, starting in 2016–17, to market Canadian agricultural and agri‑food products around the world.

- Providing $5.7 million over five years, starting in 2015–16, to help secure new market access for Canadian seal products.

- Providing $3 million over three years, starting in 2015–16, for the International Maritime Centre to attract foreign shipping companies to establish their headquarters in Vancouver.

- Supporting a new tourism marketing campaign in the United States.

- Ensuring that Canada’s trade remedy system operates in an effective, accessible and transparent manner.

- Continuing to implement the Beyond the Border and Regulatory Cooperation Council Action Plans with the United States to strengthen our long-term security and trade relationship.

- Creating an Internal Trade Promotion Office within Industry Canada to support efforts to renew the Agreement on Internal Trade.

Responsible Resource Development

- Providing accelerated capital cost allowance treatment for assets used in facilities that liquefy natural gas.

- Extending the Mineral Exploration Tax Credit until March 31, 2016.

- Continuing to support effective project approvals through the Major Projects Management Office Initiative, with $135 million over five years, starting in 2015–16.

- Providing $34 million over five years, starting in 2015–16, to continue consultations with Canadians related to projects assessed under the Canadian Environmental Assessment Act.

-

Dedicating $80 million over five years, starting in 2015–16, to the National Energy Board for safety and environmental protection and greater engagement with Canadians. This fun